Opening Ceremony lays the foundation for cross-sector collaboration and breakthrough solutions.

What An Elephant Teaches Us About Climate Finance

There’s a complex challenge at the heart of climate finance. It may be best understood through an old story about an elephant.

The well-known parable tells the story of six blind men who set out to understand what an elephant is by touching it. Each feels a different part – its side, trunk, tusk, leg, ear, tail – and each walks away with a completely different idea of what the creature looks like. They argue bitterly, each convinced of their own unique experience. It’s only when another man helps them step back and piece together their fragmented impressions that they begin to grasp the full picture: the elephant is all these things, and more, and can only be fully understood through coordinated, shared insight.

What does this tell us about climate finance?

That even with time, effort, collaboration (and a very patient elephant), efforts are futile without coordination and a shared understanding.

The elephant in the room: climate finance standards and reporting

Around the world, governments, investors, development banks, and private institutions are reaching for the same elephant: financing the transition to a low-carbon, climate-resilient future. In 2022, average annual climate finance flows reached almost USD 1.3 trillion – nearly doubling the year before. But too often, financiers are forced to make climate investment decisions based on chaotic information: different metrics, misaligned priorities, fragmented definitions, and inconsistent reporting standards.

Like the blind men from the tale, global funders risk misunderstanding the scale, direction, and impact of climate finance; not for lack of effort or intention, but for lack of a shared lens.

To move forward, we need another set of tools alongside our resources and ambition: a coordinated, transparent, and standardized way of measuring and reporting emissions, climate-related risks and opportunities, and progress towards decarbonization goals. Only then can we see the full picture, and act on it effectively.

The importance of reporting

The processes of researching and reporting emissions and progress towards targets may not be inspiring, but this data is a fundamental building block of a net zero future. The many advantages of clear standards and up-to-date reporting are self-evident: transparency, accountability, consistency, comparability, and data-driven decision-making.

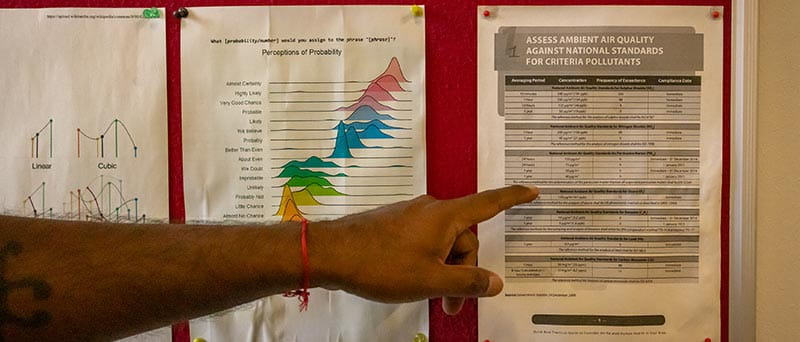

A data chart showing the ambient air quality against national standards for criteria pollutants at the CSIR offices in Pretoria, South Africa

A data chart showing the ambient air quality against national standards for criteria pollutants at the CSIR offices in Pretoria, South Africa

Worldwide, organizations are taking up the challenge of untangling the knot of standardization and reporting. Among the most prominent is the Task Force on Climate-related Financial Disclosures (TCFD) which aims to improve how companies disclose their climate-related financial risks and opportunities. The TCFD framework has become highly influential, shaping regulatory requirements and being integrated into other standards. In Europe, the European Sustainability Reporting Standards (ESRS) set mandatory climate and sustainability reporting requirements for companies operating within the EU. The Global Reporting Initiative’s Standards offer a comprehensive, stakeholder-oriented approach, reportedly used by some 14,000 organizations across 100 countries.

These frameworks and others differ in geographies, focus, and enforcement, but together they are driving a global shift toward more transparent and uniform climate disclosures and helping align financial flows with climate goals. As adoption grows and standards converge, their influence on corporate decisions is expected to deepen, accelerating the transition to a low-carbon, resilient global economy.

The role of government

These frameworks are a sizable step in the right direction, but there’s still some distance to go.

Inconsistencies in methodologies and reporting practices hamper the usefulness of reports. On a logistical level, the time and resources it takes to gather, analyze, and report robust climate data can provoke a grumble from even the best-intentioned organizations. And overall, funders and businesses operate in a marketplace that rewards short-term gains, taking the shine off the long-term investments for climate action over more immediate wins.

Government will play a crucial role here. Policymakers are uniquely positioned to level the playing field by fostering a business environment that rewards or mandates clear reporting. Their decisions will shape the architecture that we will rely on to measure climate progress. Facing a challenge as complex and interconnected as climate change, only governments can bring the scale, coordination, and authority needed to turn patchwork efforts into systemic transformation.

Seeing the whole elephant: a path forward

The future of climate finance hinges not just on how much funding flows, but on how clearly we see where it’s going, what it’s achieving, and where it falls short.

The Lolo National Forest planted 530,500 seedlings across 2,536 acres. Lolo National Forest, Western Montana, USA. Dave Gardner Creative/National Forest Foundation

The Lolo National Forest planted 530,500 seedlings across 2,536 acres. Lolo National Forest, Western Montana, USA. Dave Gardner Creative/National Forest Foundation

Without shared definitions, coherent data, and transparent metrics, even well-intentioned investments risk duplication, inefficiency, or irrelevance. The good news is, momentum is building: frameworks are evolving, adoption is growing, and governments are beginning to dangle carrots and wield sticks to encourage compliance.

If we can build on the work that has begun and commit to a common vision of what climate finance must accomplish – and how we measure it – then we may finally start to see the whole elephant, and act with the urgency and clarity this moment demands.

Politics and priorities may be shifting, but one thing that isn’t changing is that climate action needs funding, and fast. ADSW gathered experts to hear their insights on climate finance in a turbulent landscape: what’s the state of climate finance today? And what must we do to secure it for tomorrow? Watch their insights here